Hi Friends,

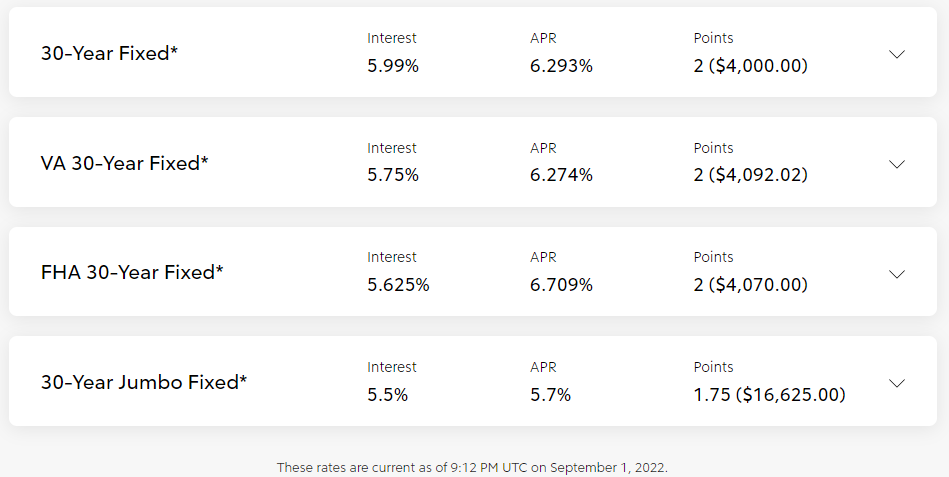

It’s hard to believe summer is over and we are prepping for Labor Day! We have seen many changes in the housing market over the past few weeks and it looks like things have shifted in favor of buyers. Over the past two year’s buyers have been up against a multiple offer market to land a property. Things are drastically slowing down due to inflation and interest rates. Prices are slowly coming down all while inventory remains low. Nevertheless, there are still great opportunities out there.

If you are thinking of buying or selling a property, I would love to help. I am always here to answer any questions you may have.

Check out Barronestates.com for more information on selling, purchasing or leasing your next home.

I will do my best to assist and educate you in finding your place called “Home, Sweet Home” for now or at last!!

Warmest Regards,

Oriana

“New Look” Barronestates.com

I am excited to announce that my website has received a major makeover! I have been working this past year at bringing a new and improved site to all of my clients and future clients. The site is much easier to navigate and allows users to search for properties directly through my site. You will also be able to access all previous newsletters as well as the current one. My goal is to provide a better user experience for everyone to make finding or selling their dream home a success. Please visit Barronestates.com for a new and improved user experience! THANK YOU for all your continued support!

1716 Courtney Ave, Los Angeles , CA 90046

4 Bed | 5 Bath | 3,806 Sqft

$3,895,000

California, of all places, could provide some indication that the housing rental market is cooling.

Overall, median rent across the country’s 50 largest metropolitan areas grew by $3 to $1,879 in July, representing the 17th consecutive monthly increase and a rise of 12.3% year over year, according to data from Realtor.com.

But in the Los Angeles-Long Beach-Anaheim metropolitan region, the fourth-most-expensive in the U.S., rent fell by $4 to $3,047. In the Riverside-San Bernardino-Ontario region, rent fell by $22, and the Sacramento area saw a $19 decrease.

The decline shows a market that is cooling off, and the rest of the country could soon see similar relief, according to George Ratiu, senior economist and manager of economic research for Realtor.com.

For Los Angeles, year-over-year rent growth peaked in April at 22%, Ratiu said. Since then, the region has seen a dramatic deceleration of rent growth, with prices in July up about 4% from a year earlier.

The San Diego, San Jose and Bay Area regions — the three most expensive metro areas in the country — continued to see increases in July, but the rates in California are nonetheless encouraging, Ratiu said.

“I think it’s so relevant to look sometimes at individual markets because you get a different read,” Ratiu said. “The national picture looks homogeneous, but as we know, real estate markets are not homogeneous by any stretch.”

Nationwide, the pinch is being felt across large cities, which saw an exodus of renters at the start of the pandemic, as well as suburbs.

“Whether in a downtown area or suburb, staying put or making a change, renters are stuck between a rock and a hard place when it comes to affordability,” said Realtor.com chief economist Danielle Hale.

Signs of the slowdown seen in California are already being hinted at in national numbers.

Though median rent nationwide hit an all-time high in July, the increase over June’s median rent was the smallest so far in 2022. It also marked the lowest year-over-year growth since August 2021.

“I do think that what we’re seeing in California markets today, in a sense, pencils out the trajectory for the national rental markets as well,” Ratiu said.

Rent increases in California peaked faster and dropped sooner than in other parts of the country, Ratiu said.

“It’s a natural rebalancing of housing markets after a really feverish and highly unusual two-year period, in which so many things have been distorted, both economically and financially,” he said.

According to a survey by Avail, a property management platform owned by Realtor.com, 60% of renters reported that increasing rental prices and household expenses were their biggest causes of financial strain.

The survey also found that more than half of renters who had been in their current apartments for one to two years had experienced a rent increase, with a median increase of $160 per month.

As the housing market has slowed across Southern California and the country, sellers have had to adjust their expectations.

Homes that would have received dozens of offers at the beginning of the year get just a few these days. Other properties receive none, forcing owners to slash their asking price and relinquish dreams of record profits.

Now, some would-be sellers are calling it quits all together. Those decisions essentially cap how high inventory can climb, with broad implications for current homeowners and future buyers.

“It puts a floor on home values if people decide not to list their homes,” said Ralph McLaughlin, chief economist with real estate data firm Kukun, noting fewer homes to choose from helps keep prices from plunging.

According to real estate agents, reasons vary for the wait-and-see approach.

Some owners want to sell only if they can get a certain price that’s now tough in a market slowed by rising rates.

Others have a mortgage with the 3%-and-under interest rates of the past and don’t want to ditch it to borrow at 5%. With fears of a recession heightened, there’s also hesitation that comes with any economic uncertainty.

“The people who are still interested in selling are the people who are having life changes — babies, death, divorce, marriage,” said Lindsay Katz, a Los Angeles agent.

For Ara Kassabian, there’s no deadline forcing his hand. The 56-year-old software engineer wants to eventually sell his three-bedroom home in Glendale, take the proceeds and retire in Portugal.

He had been planning to do that in coming months, but no longer.

If he sold his home now, Kassabian estimates he’d pocket a couple of hundred thousand dollars less than if the market had stayed hot — extra money that could’ve gone a long way in Portugal, a country that has emerged as a destination for Californians seeking a more affordable lifestyle.

“If I wait a year, probably the market will take off again, and I could get a lot more,” he said. “I am not being pushed out of work.”

Across the country, Redfin data show the total number of homes for sale in major metro areas was nearly 4% higher in the four weeks ended Aug. 7 than the same period a year earlier.

But the rise is largely because the homes that hit the market are taking longer to sell. Over the same period, the number of homes listed for the first time fell nearly 12%.

The same pattern — more total homes for sale but fewer new listings hitting the market each month — can be seen in Riverside, San Bernardino, Ventura and San Diego counties.

In Orange County, total inventory is essentially flat from a year earlier, and new listings are down sharply.

In Los Angeles County, Redfin data show there were 7% fewer homes for sale during the four weeks ended Aug. 7 than a year earlier, and the number of new listings plunged 30%.

In mid-May, before the market cooled drastically, the total number of homes for sale in L.A. County was down nearly 16% from year-earlier levels, and the number of new listings was down 0.7%.

What happens next depends on a variety of factors, including the direction of mortgage rates and the overall economy.

Home price appreciation is slowing, but prices are still up compared with those of last year.

Some economists think prices will keep climbing, but at a slower pace than in recent years. Others predict Southern California home prices will fall by the mid- to upper single digits in 2023.

Where the two sides agree is that the instinct to avoid selling in a slow market is a major reason why home values shouldn’t plunge as they did when the early-2000s bubble burst.

Then, a wave of forced selling at a loss — through foreclosures and short sales — tanked the market and brought Southern California prices down 50% over two years, according to one gauge from real estate firm DQNews.

If unemployment rises, more people may lose their homes to foreclosure or otherwise be forced to sell, putting increased downward pressure on prices, said Redfin chief economist Daryl Fairweather.

But she and many other economists say any economic downturn should be relatively mild, and tighter underwriting standards during this housing boom should limit forced sales in the case of job losses.

“Homeowners, unlike [right before] the Great Recession, are very financially stable,” Fairweather said, citing higher credit scores and down payments. “It would take a lot for them to be in a position where they have to sell.”

One other option owners have is to rent out their property, an attractive alternative because the market for leases is still extremely competitive.

In the last month, Kevin Chen, a Southern California house flipper, has listed about five homes for rent that he had planned to sell until the housing slowdown squeezed his profit margin.

On some deals, he estimated he would have even lost money if he had sold. One of those was a five-bedroom house in the Inland Empire city of Highland that Chen instead listed for $3,150 a month.

About 15 potential renters showed up at the open house, with several telling Chen the same thing.

“We were looking for something to buy,” Chen recalled being told. “And all of a sudden we couldn’t afford it anymore because of the interest rates.”

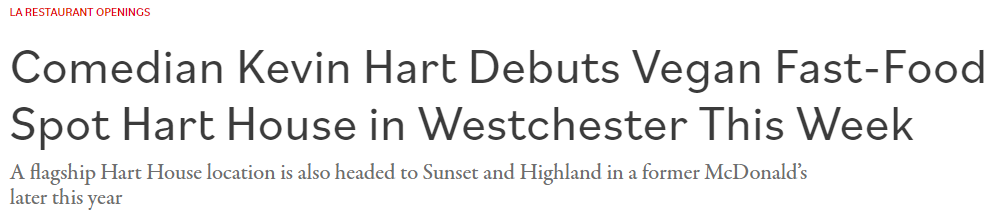

Actor Kevin Hart’s first plant-based fast-food restaurant will be up and running this Thursday in Westchester. Located at 8901 S. Sepulveda Boulevard, Hart House is less than a four-minute walk away from the LAX-adjacent location of In-N-Out-Burger, which is always impossibly busy. Last week, Hart broke the news in an exclusive interview with Eater LA that Hart House currently has two locations under construction, several signed leases, and is on target to open up to 10 Hart Houses over the next year.

Hart isn’t the first celebrity — or the last — to open a restaurant in Los Angeles. But he might be the first to open a vegan fast-food restaurant. Though not a full vegetarian — Hart openly says he takes a flexible approach that works for him, with no red meat or dairy — he started looking at the plant-based way of eating as a lifestyle. But he also wondered about accessibility for those who can’t afford to dine out at most vegetarian restaurants.

“We wanted a price that doesn’t turn customers away,” says Hart. “It was extremely important to us from the beginning to make [affordability] a massive priority.”

Hart then recruited restaurateur Andy Hooper and chef Mike Salem with the goal of keeping the prices low and menu appealing. Salem is the former head of culinary Innovation at Burger King, where he helped launch the Impossible Whopper; he developed all of the Hart House menu items, which he describes as “straightforward.”

At Hart House, burgers are available, but so is a crispy chick’n sandwich with mayo and pickles, which can also be dipped in chile oil to spice things up. There are also crispy chick’n nuggets with dipping options like creamy ranch, barbecue, and buffalo sauces. Additionally, the menu offers salads, french fries, tots, iced teas and limeade, and a stunningly similar-to-the-real-thing item: a milk shake made from an oat-and-soy blend.

Hooper shared that the second location will open in Hollywood on the southwest corner of Highland Avenue and Sunset Boulevard in a former McDonald’s. That central spot will be Hart House’s flagship and drive-thru location, directly across from Hollywood High School and Chick-fil-A, and one block away from Hollywood’s own In-N-Out. It’s quite a strategy given the constant traffic and famous streets, but this time a plant-based restaurant will anchor the corner lot.

Los Angeles has exploded with plant-based fast food options over recent years with the growth of restaurants like Monty’s Good Burger, Plant Power Fast Food, Veggie Grill, and Mr. Charlie’s. Though Hart House is similar to Monty’s and Plant Power, the standout is the price. Hart House sandwiches and burgers are in the $5 to $7 price range.

Hart draws a parallel between his venture to his acting and comedy career. “For me, it’s about getting the customers that aren’t necessarily your target or your demographic,” says Hart. “You’re trying to appeal to all. [Hart House] is plant-based, but it’s really good. How can we get everybody to say ‘I want Hart House today.’ That’s something I’ve been able to do in my career. I’ve been able to travel the globe and do my job at a very high level by appealing to everyone. So for Hart House, I want [it] to match the world of me and what I’ve done, and have that same global appeal as we grow and as we go.”

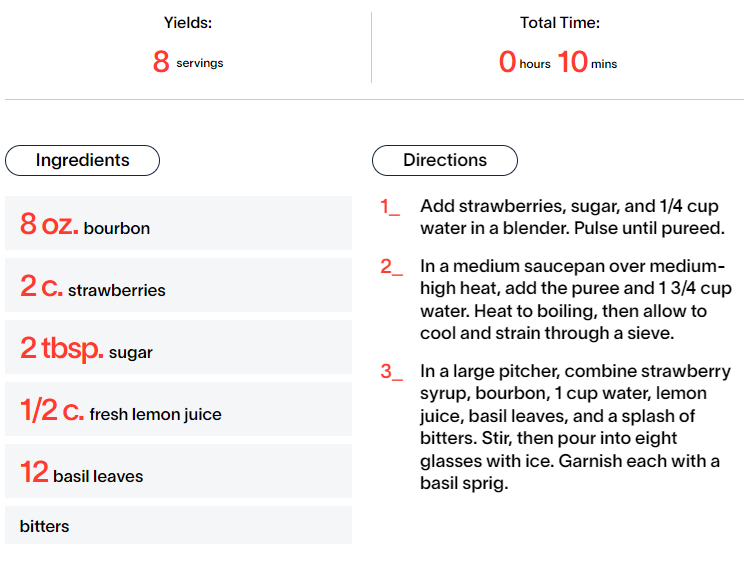

Lemonade is the drink of the summer. Well, negronis and margaritas are technically the drinks of the summer, but we’ve been enjoying those for three months now. As summer winds down and you open your backyard up for the last hoorah of the season, mix up a batch of boozy lemonade for your guests. This recipe for strawberry basil bourbon lemonade, resurfaced from our list of favorite summer cocktails, is a real crowd-pleaser. If you don’t plan on hosting a Labor Day shindig, then drink the pitcher yourself. Cheers to a much-needed long weekend!!

Spicy Passionfruit Margarita

Ingredients:

- Grand Marnier: This is a type of triple sec, which is an orange liqueur made from dried orange peels. Feel free to use a different triple sec, like Cointreau, in this recipe instead.

- Passion Fruit Purée: Fresh passion fruits can be hard to find (and more work to prepare), so I prefer this passion fruit purée. But you could absolutely use fresh passion fruit pulp instead. You might also try passion fruit nectar or passion fruit juice, but look for ones with no extra sugar or additional ingredients.

- Lime Juice: Fresh lime juice is the only way to go with margaritas. Squeeze your own, and taste the difference! A lemon/lime squeezer makes this quick and easy.

- Jalapeño Pepper: For a spicier version, try using a Serrano pepper instead. For a less spicy version, remove the seeds from the jalapeño before crushing.

- Chili Powder: Any kind will work here: ancho, chipotle, etc. You could also replace with smoked paprika or piment d’espelette.

- Agave Nectar: This nectar has a low glycemic index and is often sustainably sourced. You could replace it with simple syrup or maple syrup.

Fill glasses with ice. Add all but 4 jalapeño slices to the bottom of a cocktail shaker, and use a muddler to crush them gently. Then fill shaker with ice, and add 3 ounces tequila, 1 ounce grand marnier, 2 ounces passion fruit purée, 1.5 ounces lime juice, and .25 ounce agave nectar. Shake well so that the outside of the shaker becomes quite cold, then strain into the prepared glasses.

Serve each drink with a slice or two of jalapeño on top.

![]()