Hi Friends,

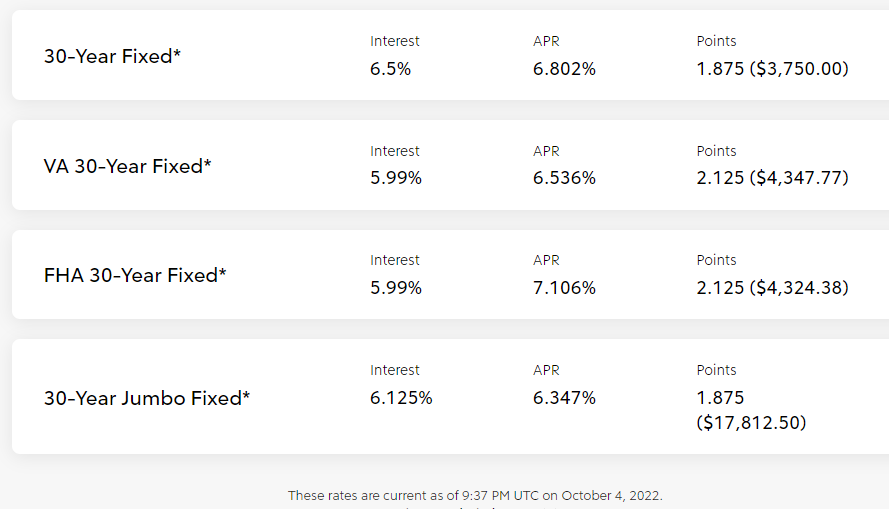

October is here and so is the cooler weather. We are getting closer to pulling out our favorite sweaters and jackets in the evening as the season starts to change. Along with the change in season so has the market. Today, interest rates are the highest they have been in over a decade and continue to rise which makes homebuyers uncertain about how high rates could go.

In the LA market we are starting to see more and more homes come on the market which means home prices have started to cool off. It is a buyers market and if you have waited for prices to come down now might be the right time.

If you are thinking of buying or selling a property, I would love to help. I am always here to answer any questions you may have.

Check out Barronestates.com for more information on selling, purchasing or leasing your next home.

I will do my best to assist and educate you in finding your place called “Home, Sweet Home” for now or at last!!

Warmest Regards,

Oriana

“New Look” Barronestates.com

I am excited to announce that my website has received a major makeover! I have been working this past year at bringing a new and improved site to all of my clients and future clients. The site is much easier to navigate and allows users to search for properties directly through my site. You will also be able to access all previous newsletters as well as the current one. My goal is to provide a better user experience for everyone to make finding or selling their dream home a success. Please visit Barronestates.com for a new and improved user experience! THANK YOU for all your continued support!

![]()

Think mortgage rates are high now? Connie Strait remembers when she was starting her career in real estate in the early 1980s and buyers were contending with rates three times higher.

Strait recalled one couple who were actually relieved when they locked in a 30-year fixed-rate mortgage at 19% in September 1981. The couple had told her they were hoping to close on their new home before rates moved any higher.

“They were so delighted to be closing at 19%,” said Strait, who now works at William Raveis Real Estate in Danbury, Connecticut. “They said, ‘We made it in just under the wire, next week it is going to 20%!’”

The following month, in October 1981, the average weekly interest rate for a 30-year, fixed rate loan hit an all-time high of 18.6%, according to Freddie Mac. The average mortgage rate is based on a survey of conventional home purchase loans for borrowers who put 20% down and have excellent credit. But many buyers pay even more.

This week, the 30-year fixed-rate mortgage rate hit an average of 6.70%. Although it may come as cold comfort to someone who let a 3% rate slip through their fingers just seven months ago, today’s interest rates are, historically speaking, still relatively low.

“Unfortunately, now people don’t remember how Baby Boomers were getting rates of 10%, 12% and higher for most of the 1980s,” Strait said. “Meanwhile, our kids are shocked by 6%.”

Those ultra-high rates made homeownership less affordable in the early 1980s than it is now. By the mid-1980s though, mortgage rates had fallen somewhat, making financing more affordable, even with rates near 10%.

But many things have changed since the 1980s.

Given wage growth, sky-high home prices and rapidly rising interest rates, homes today are the least affordable they have been in 35 years.

Home affordability has worsened

Mortgage rates were high in the 1980s, but home prices were a lot less expensive, too.

In October 1981 a typical home cost $70,398. But with mortgage rates averaging 18.45% that month, the $870 monthly payment took up about 55% of the median income at the time, according to Black Knight, a mortgage data company.

By October 1986, rates had dropped to 9.97% and a typical home was $91,488. That brought the monthly payment down to $640, and took up just 30% of the median income.

“If you reduce interest rates by 8.5% that doubles your buying power,” said Andy Walden, vice president of enterprise research at Black Knight.

With the typical home currently costing $434,978, and rates over 6%, the monthly mortgage payment of $2,061 eats up more than 36% of the median monthly income, according to Black Knight.

“When we lower interest rates it allows home prices to grow much more quickly than incomes,” said Walden. “It gives folks the ability to buy more home with the same amount of income. So a 1% decline in interest rates allows you to buy 10% to 12% more home, with the exact same amount of money.”

Interest rates have been below 5% for the past 11 years, with the weekly average reaching an all-time low of 2.65% in January 2021. That’s part of the reason why home prices are so high today.

Incomes aren’t keeping up

Making affordability matters worse, home prices are significantly out of whack with income levels.

Over the past five years, while the average home price has gone up 60%, the average income has risen less than 15%.

“We now have the highest ratio of home price to income that we’ve seen in the past 50 years plus,” said Walden. “We have data going back to 1970 and it is the highest we’ve seen by far.”

Historically, home prices were between three to four times the median income, a ratio that remained consistent from 1975 until 2000, according to Black Knight. In 2000, as interest rates began to drop below 8%, the ratio began to rise, reaching a point in 2005 where home prices were almost five and a half times the median income.

The sharp rise in 2005 was largely fueled by expanded credit in the mortgage market, said Walden, with mortgages being offered based on a buyer’s unverified income, and through products like interest-only, adjustable-rate and negative amortizing loans.

“That allowed those shopping to buy more home than their income level would traditionally support,” he said. It also created a bubble that led to the 2008 housing crash.

Today, the typical home price is six times the median household income of about $71,000.

Credit availability has greatly increased

Another reason why rates were so high in the 1980s was that there was less credit available to borrow, making it more difficult and costly for buyers to secure a mortgage. Banks had to charge higher rates for taking on the risk. But today’s mortgages are often bundled and sold into investment products. That secondary market makes it profitable for lenders to give loans to many more people, and at lower interest rates.

“Back in the early 1980s, rates were in the mid- to upper-teens,” said Pete Miller, senior vice president for residential policy at the Mortgage Bankers Association. “Part of the reason was that the supply of mortgage credit was more constrained. We didn’t have the secondary market liquidity we have today.”

Miller – who bought his first home in California in the mid 1980s with a 13% adjustable rate mortgage – said 6% for a fixed-rate 30-year loan is historically a very good interest rate.

“I remember when interest rates went to single digits and saying, ‘I thought that would never happen.’”

The Southern California median home price remained unchanged in August from the previous month as rising mortgage rates made houses even less affordable for many people.

The six-county region’s median held steady at $740,000, the fourth consecutive month prices didn’t increase, according to data released Tuesday by real estate firm DQNews.

Sales of new and existing houses, condos and townhomes dropped 28.3% from a year earlier.

The housing market has slowed sharply in recent months, a consequence of rising mortgage rates that priced many would-be buyers out of the market.

Rates have more than doubled in the last year and topped 6% last week for the first time since 2008. The steep rise in borrowing costs adds more than $1,000 to the monthly payment for a median-priced home of $740,000 — a cost many can’t afford.

For buyers who can stomach the increases, there are some bright spots. The Southern California median price — the point at which half of homes sold for more and half for less — is 2.6% less than the all-time high reached this spring.

And compared with the white-hot market of recent years, the buying experience could be less stressful, without the need to bid on dozens of homes before either securing one or giving up altogether.

“That maddening competition is gone,” said Jeff Lazerson, president of brokerage Mortgage Grader, noting sellers are more open to low down payment offers they previously would have ignored.

When it comes to individual counties, the median is down more than regionwide, ranging from 2.8% below the all-time high in Riverside County to 6.7% below the peak in Orange County.

Compared with July, the median fell in all counties except Riverside. In Orange County, the median dropped below $1 million, a threshold the pricey county hit for the first time in March.

Because the median is the midpoint of all sales, changes to it reflect both a change in actual values and in the type of homes selling in a given month.

Selma Hepp, an economist at real estate firm CoreLogic, said declines in the stock market have contributed to a bigger drop-off in luxury home sales, which exaggerated the declines in the median.

Zillow data show declines since the peak that range from a 0.5% drop from the all-time high in San Bernardino County to a 2.6% decline in San Diego County.

By whatever measure, prices in all counties are higher than a year earlier, a reflection of strong demand before rates shot up.

Regionwide, the median is 8.8% higher than a year earlier, which combined with higher rates means housing is drastically more unaffordable than in 2021.

The year-over-year increase in prices is getting smaller. In April, prices were up nearly 17% from a year earlier, and a growing number of economists predict home prices will turn negative on a year-over-year basis in 2023.

But few, if any, major analysts predict declines similar to those seen in the Great Recession.

That’s in large part because even in the event of a recession, experts say tighter lending standards should limit the number of foreclosures, a wave of which sent Southern California prices down 50% from 2007 to 2009.

According to the California Assn. of Realtors, home prices statewide and in Southern California are likely to fall about 7% in 2023 compared with 2022, in part because mortgage rates are expected to stay elevated.

A home price measure from Zillow, which tries to account for such changes in the mix of homes selling, shows the price of a typical home is still above $1 million in Orange County and overall prices in Southern California haven’t fallen as much as the median indicates.

Not all Halloween events are hell-bent on scaring you straight. Well, alright, a lot of them are, but in addition to haunted houses and spooky screenings you’ll also find some family-friendly activities and trick-or-treating opportunities.

To make your Halloween planning a little bit easier, we’ve split this feature in two: scary and adult-focused events are toward the top with a whole section of kid-friendly events about halfway down the page.

Outside of these picks, if you’re looking for a real taste of the fall, you’ll find apple picking aplenty and—for the thrill-seekers—some real-life haunted places. But if you simply want something festive, there’s no shortage of worthwhile Halloween events in Los Angeles.

Looking to pick out the perfect pumpkin? You’re in the right place. Whether you’re looking for a quaint patch where you can pick up your squash and go or a massive farm featuring family games, tractor rides, corn mazes, petting zoos and Halloween events, there are plenty of patches in L.A. to suit your fancy. Every October, tiny parking lot patches sprout up all over the city and local farms bring out their best orange squash—from tiny little fellas to massive twenty-pounders. The next time you’re looking to carve with family and friends or perhaps whip up some tasty pumpkin desserts (hello, pumpkin pie), check out our guide to the best pumpkin patches in Los Angeles.

![]()