Hi Friends,

It is June and that means Summer is here and just like that we’re half way through 2022. These first 6 months have been a wave of emotions for real estate, the economy and our nation. The summer is always the hottest time to list or purchase a home and the second half of this year will be a test to see if the buyers wave continues. Rates are continuing to rise which could mean the housing surplus of buyers will slow down, but only time will tell.

If you are thinking of buying or selling a property I would love to help. I am always here to answer any questions you may have.

Check out Barronestates.com for more information on selling, purchasing or leasing your next home.

I will do my best to assist and educate you in finding your place called “Home, Sweet Home” for now or at last!!

Warmest Regards,

Oriana

JUST SOLD

1088 Villa Grove Dr, Pacific Palisades, CA 90272

4 Bed | 3.5 Bath | 4,367 Sqft

$4,599,000

My clients, who are first time home buyers had focused on purchasing a home in the Brentwood area, but were worried about the low inventory and pricey homes in the area. After searching for years and looking at different areas in and around LA, I helped navigate them to homes in the Pacific Palisades. I found them this magnificent home in a beautiful community in the quintessential neighborhood of the Palisades. We quickly put an offer in and it was accepted at the asking price, immediately giving them instant equity! Congratulations to my clients for trusting in me to find them the perfect home for their family!

Home listings suddenly jump as sellers worry they may miss out on the red-hot Housing market

Sharply higher mortgage rates have caused a sudden pullback in home sales, and now sellers are rushing to get in before the red-hot market cools off dramatically.

The supply of homes for sale jumped 9% last week compared with the same period a year ago, according to Realtor.com. That is the biggest annual gain the company has recorded since it began tracking the metric in 2017.

Real estate brokerage Redfin also reported that new listings rose nearly twice as fast in the four weeks ended May 15 as they did during the same period a year ago.

“Rising mortgage rates have caused the housing market to shift, and now home sellers are in a hurry to find a buyer before demand weakens further,” said Redfin Chief Economist Daryl Fairweather.

Sellers clearly see the market softening. Pending home sales, a measure of signed contracts on existing homes, dropped nearly 4% in April from March. They were down just over 9% from April 2021, according to the National Association of Realtors. This index measures signed contracts on existing homes, not closings, so it is perhaps the most timely indicator of how buyers are reacting to higher mortgage rates. It marks the sixth straight month of sales declines and the slowest pace in nearly a decade.

April sales of newly built homes, also measured by signed contracts, dropped a much wider-than-expected 16% compared with March, according to the U.S. Census.

Sales are slowing because mortgage rates have risen sharply since the start of the year, with the biggest gains in April and early May. The average rate on the 30-year fixed mortgage started the year close to 3% and is now well over 5%.

“We used to get 10 to 15 offers on most houses,” said Lindsay Katz, a real estate broker at Redfin in the Los Angeles area. “Now I’m seeing between two and six offers on a house, a good house.”

Katz worked with Alexandra Stocker and her husband to sell their home. The Stockers were already worried that the red-hot housing market was suddenly chilling.

“We talked about that a lot. Like, are we making mistake here? Are we missing the boat? Is everything going to crash in the next three months and we’re going to kick ourselves for not selling our house earlier this year?” said Alexandra Stocker.

While home prices rose steadily during the first two years of the Covid pandemic, falling mortgage rates largely offset those increases.

For example: In May 2019, a buyer purchasing a $300,000 home with a 20% down payment and a 30-year fixed mortgage would get an average interest rate of around 4.33%. The monthly payment of principal and interest would be $1,192. In 2020, that same house was 5% more expensive, but mortgage rates fell to 3.41%, so the monthly payment actually dropped to $1,119.

By 2021, the monthly payment was only up about $100. This month, with prices rising another 21%, and mortgage rates surging to around 5.5%, the monthly payment hit $1,991 – almost $800 a month more than it was in 2019.

While home sellers were in the driver’s seat barely six months ago, they are now seeing far less competition from buyers. A demand index from Redfin, which measures requests for home tours and other homebuying services, was down 8% year over year during the week ended May 15. This was the largest decline since April 2020, when the pandemic paused most homebuying activity.

“I met with sellers in February who are going to sell in June, and it’s a very different conversation in February than it will be in June because the market has completely changed,” said Katz.

The Stockers are thrilled they listed their home when they did. They are moving out of California and building a home in Washington state.

“We joke we might be getting out of here, you know, just at the right time,” said Alexandra Stocker. “I wouldn’t want to wait any longer.”

Home Prices Surge 20.6% In Biggest Spike This Century – And Expert’s Say It’s Unclear When They’ll Drop

Though rising interest rates have started to temper demand in the booming housing market, home prices still skyrocketed at the highest rate in 35 years in March, according to industry data released Tuesday, and experts say it’s still too tough to tell when hot prices will begin to cool.

Home prices across the country skyrocketed 20.6% in March on an annual basis, climbing 2.6% from one month earlier, when prices surged 20% year over year, according to the closely watched S&P CoreLogic Case-Shiller Indices.

Prices in the nation’s largest cities swelled even more rapidly, with the Case-Shiller 20-City Index, which measures prices in cities such as New York, Los Angeles and San Francisco, climbing 21.2%.

Tampa, Phoenix, and Miami reported the highest year-over-year gains among the 20 cities in March, with Tampa home prices jumping 34.8% year over year to unseat Phoenix prices, which posted a 32.4% increase and led gains nationwide for nearly three years.

“Those of us who have been anticipating a deceleration in U.S. home prices will have to wait at least a month longer,” S&P DJI managing director Craig Lazzara said in a Tuesday statement, pointing out that prices nationwide and in 20 of the largest metropolitan areas grew at the quickest rate in more than 35 years.

“Although one can safely predict that price gains will begin to decelerate, the timing of the deceleration is a more difficult call,” Lazzara says. “Mortgages are becoming more expensive as the Federal Reserve has begun to ratchet up interest rates, suggesting that the macroeconomic environment may not support extraordinary home price growth for much longer.”

Historically high savings rates, government stimulus measures, low supply and interest rates helped ignite a home buying frenzy during the pandemic, but signs of a slowdown have emerged as the Fed embarks on its most aggressive interest-rate hiking cycle in two decades. Last week, new data showed pending home sales slid for the sixth consecutive month in April to the lowest level in nearly a decade, while new home sales last month plunged nearly 17% from March.

Before the pandemic, home prices were rising at less than 4% on an annual basis.

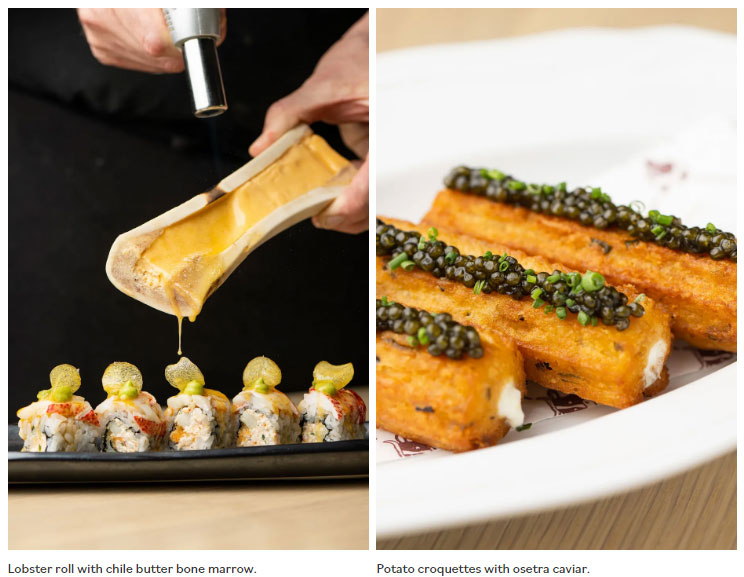

Catch’s New Steakhouse Is the Glitziest Spot in West Hollywood

For those who like their steaks with a side of celebrity, Catch Steak arrives in West Hollywood this Monday, June 6. Located in the palatial 10,000-square-foot space formerly occupied by Fig & Olive on Melrose Place, the contemporary steakhouse comes from Catch Hospitality Group, which also operates seafood hotspot Catch LA located a half mile away. Catch Steak will initially open for dinner service and introduce weekend brunch in the coming months.

This is the third location of Catch Steak; the Aspen outlet opened last December while the original location debuted in New York City in 2019. The split-level restaurant on Melrose Place, designed by the Rockwell Group, takes cues from the original Catch Steak in New York City’s Meatpacking District and features warm wood details, leather banquettes, and blackened metal touches. The abundance of greenery throughout the 375-seat space provides a verdant setting for both indoor and outdoor dining. Though Catch Steak anticipates serving up to 1,000 diners on Friday and Saturday evenings, Michael Vignola, corporate chef of Catch Hospitality Group, says that the space is “designed in a way that makes it feel intimate. Our goal is always to have a 60-seat restaurant experience in a larger restaurant.”

At the heart of Catch Steak’s menu is a vast selection of beef. On the premium end of the spectrum is imported Japanese wagyu ($48 to $58 per ounce), while American-sourced USDA prime beef (grain-fed and corn-finished Black Angus and Hereford steers) goes slightly easier on the wallet; a 12 ounce bone-in filet is priced at $68. Also available are cave-aged steaks, American wagyu, and a grass-fed New York strip. The restaurant sources its American beef from six cattle farms (Iowa, Nebraska, Idaho, Colorado, and Washington); steaks are processed and hand-sliced in Chicago by Allen Brothers before landing in Catch’s restaurants, says Vignola. Rounding out the menu are classic steakhouse sides like shrimp cocktail, a wedge salad, and creamed spinach, along with more unexpected Asian- and Italian-leaning dishes like the salmon rice cakes, baked clams, and tortellini.

In addition to offering plenty of red meat in a variety of cuts and price points, the menu includes a smattering of shareable dishes and mains aimed at those cutting back or refraining from eating beef, like salmon, sushi rolls, and even a vegetarian chicken parm. While the Los Angeles menu doesn’t veer too far from what’s served in Aspen or New York City, expect to find more seasonal, unique-to-LA dishes in the future as the restaurant settles into its space and executive chef Erik Piedrahita gets to know the tastes of local diners better.

It takes a tremendous amount of human capital to run a restaurant of Catch Steak’s scale smoothly seven nights a week. While many LA restaurants are currently struggling to find and retain workers, Catch Steak has benefited from strong word-of-mouth among local hospitality professionals due to the reputation of its sister restaurant and the group’s commitment to the mental and physical well-being of workers. “Our rule for the entire company is that we take care of staff first, staff takes care of the guests, and the guests will eventually take care of the bills,” says Michael Ilic, director of operations for Catch Hospitality Group. “We recognize that the kind of energy we want [workers] to put into the experience, and if people are burning out or people are working double-shifts or open-to-close, they don’t have the emotional energy to be able to create the experience.”

To provide a sustainable work environment for its 200-plus workers, employees are scheduled for five-day work weeks and receive benefits like health and dental after 90-days of employment. Tips are pooled and shared among front-of-house employees who earn minimum wage, while back-of-house employees earn above minimum wage and can receive “merit” increases periodically and during annual reviews. Additional benefits include gym memberships, along with coaching and leadership training for front- and back-of-house managers.

Though this opening marks the third Catch Steak location, the partners behind Catch Hospitality Group have deep knowledge and experience that stretches beyond the Catch brand. Partner Tilman Fertitta, who owns Landry’s Incorporated, operates 600 restaurants including many household names like Del Frisco’s, Mastro’s, and Morton’s. Partners Mark Birnbaum and Eugene Remm opened the original Catch in 2011 and have since expanded the seafood restaurant to Los Angeles, Las Vegas, and Playa del Carmen in Mexico.

To provide a sustainable work environment for its 200-plus workers, employees are scheduled for five-day work weeks and receive benefits like health and dental after 90-days of employment. Tips are pooled and shared among front-of-house employees who earn minimum wage, while back-of-house employees earn above minimum wage and can receive “merit” increases periodically and during annual reviews. Additional benefits include gym memberships, along with coaching and leadership training for front- and back-of-house managers.

Though this opening marks the third Catch Steak location, the partners behind Catch Hospitality Group have deep knowledge and experience that stretches beyond the Catch brand. Partner Tilman Fertitta, who owns Landry’s Incorporated, operates 600 restaurants including many household names like Del Frisco’s, Mastro’s, and Morton’s. Partners Mark Birnbaum and Eugene Remm opened the original Catch in 2011 and have since expanded the seafood restaurant to Los Angeles, Las Vegas, and Playa del Carmen in Mexico.