Hi Friends,

As we near the closing of yet another year, the Thanksgiving holiday always allows me to stop and reflect on everything in my life I am thankful for. These past few years have been difficult for all of us in the world. Los Angeles in particular has seen its share of ups and downs and the housing market is unlike anything we have seen in decades.

I want to take some time to pause and THANK each and every one of you that subscribes to my monthly newsletter. Real Estate is a passion of mine, but so is helping others. I got into this industry to help people, I am truly blessed I get to work with so many families.

If you are thinking of buying or selling a property, I would love to help. I am always here to answer any questions you may have.

Check out Barronestates.com for more information on selling, purchasing or leasing your next home.

I will do my best to assist and educate you in finding your place called “Home, Sweet Home” for now or at last!!

Warmest Regards,

Oriana

“New Look” Barronestates.com

I am excited to announce that my website has received a major makeover! I have been working this past year at bringing a new and improved site to all of my clients and future clients. The site is much easier to navigate and allows users to search for properties directly through my site. You will also be able to access all previous newsletters as well as the current one. My goal is to provide a better user experience for everyone to make finding or selling their dream home a success. Please visit Barronestates.com for a new and improved user experience! THANK YOU for all your continued support!

The cost of buying a home took another leap this week as the average rate on the popular 30-year fixed-rate mortgage surpassed 7% for the first time since 2002.

It was just last month that rates climbed above 6% for the first time in 14 years. The latest dramatic jump makes a home purchase even more unaffordable and stands to further slow a market already reeling from the rising borrowing costs.

“It’s crazy,” said Tressa Pope, a Los Angeles-area mortgage broker. “Rates rose so rapidly that people weren’t prepared.”

Only in the early 1980s, another time of high inflation, did rates rise quicker than they have in recent months. Although rates are still below the historical average of 7.76%, it’s the sudden change that’s upending the market.

For much of the COVID-19 pandemic, the Federal Reserve’s easy money policies held mortgage interest rates below 3% and enabled people to make larger and larger offers.

Southern California home prices rose nearly 40% in two years. Pandemic boomtowns such as Boise, Idaho, and Phoenix saw larger gains.

But this year, inflation and the central bank’s efforts to tame it have caused rates to more than double.

With rates rising so quickly, buyers have had to try to buy homes with values set when money was cheap. Many can’t.

Home sales are plunging across the country and, in some markets, prices are falling but nowhere near fast enough to balance out the rising interest rates.

In Southern California, prices are now nearly 6% off their peak in May, according to Zillow.

In Los Angeles County, the typical home value, which Zillow defines as the average of the middle third of the market, was $835,546 in September, 6.7% below the peak.

On Thursday, mortgage firm Freddie Mac reported that the average cost on a 30-year fixed-rate home loan was 7.08% this week, up from 6.94% last week and 3.14% a year earlier.

If rates hold above 7%, economists said it’s likely to send prices down more than if they held in the 6% range, because most Americans need a mortgage to become homeowners.

An increase from 6% to 7.08% adds $475 to the monthly mortgage payment on a $835,546 house, assuming a borrower put 20% down.

Compared with the 3.14% rate of last year, the increase to above 7% adds an additional $1,614 monthly.

Another way to think of the difference? With a 3.14% mortgage rate, a $3,000 principal and interest payment would snag you a $873,600 house, with 20% down. With a 7.08% rate, the same payment gets you a $559,200 house.

Pope, founder of TPG Mortgage Lending, said a “big chunk” of her clients are now on the sidelines. Either they’ve been priced out altogether or are wary of making a poor financial decision, given the uncertainty over the direction of home prices and rates.

With home buying plans on hold, it’s also changing other aspects of people’s lives.

Florist Tracey Morris, 52, frequently drives 40 miles home to Buellton in the middle of the night after working weddings and events in Santa Barbara and its neighboring beach cities.

For a while, her condo’s rising equity during the pandemic gave her a chance to ditch the grueling commute and move closer to work. But she called off the plan when rates hit 6%, because she could no longer afford a home near Santa Barbara without significantly cutting back or getting a roommate.

So instead, she said, she’s “going to scale back some of my business and try to do less driving,” perhaps even take the time to travel.

“I do like the idea of not being overcommitted on a mortgage and having that extra freedom to go do something else,” she said.

For those still willing and able to buy, they may find it a relatively easier experience than at the beginning of the year.

Multiple offers are far less common, and sellers are increasingly willing to give buyers money to pay their closing costs or buy down their interest rate.

Pope said based on a recent quote for a $800,000 house with 5% down, a seller credit of $17,500 lowered a 6.75% rate to the equivalent of 4.75% for the first year and 5.75% for the second year, before reverting to the original rate for the remaining term of the loan. To qualify, borrowers must still show they can afford payments at 6.75%.

A similar-sized seller credit could also lower the rate for the entire 30 years to 6%, Pope said.

If home prices keep falling, it could eventually offset the rise in mortgage rates and allow more people to afford a home.

But for now, rising rates mean that if someone purchased a home at today’s somewhat lower home prices, they’d still pay hundreds of dollars more per month than buying at the peak, according to a Zillow analysis that assumed 20% down in both cases.

A growing number of economists do expect prices to keep declining through at least 2023. And a recent forecast from the Mortgage Bankers Assn. predicted that by the end of next year rates will have fallen to around 5.4%, driven lower by a slowing economy.

Many experts don’t predict a housing crash similar to the one that occurred during the Great Recession, in large part because of tighter lending standards. But some analysts say home prices could still decline by double-digit percentages from the peak.

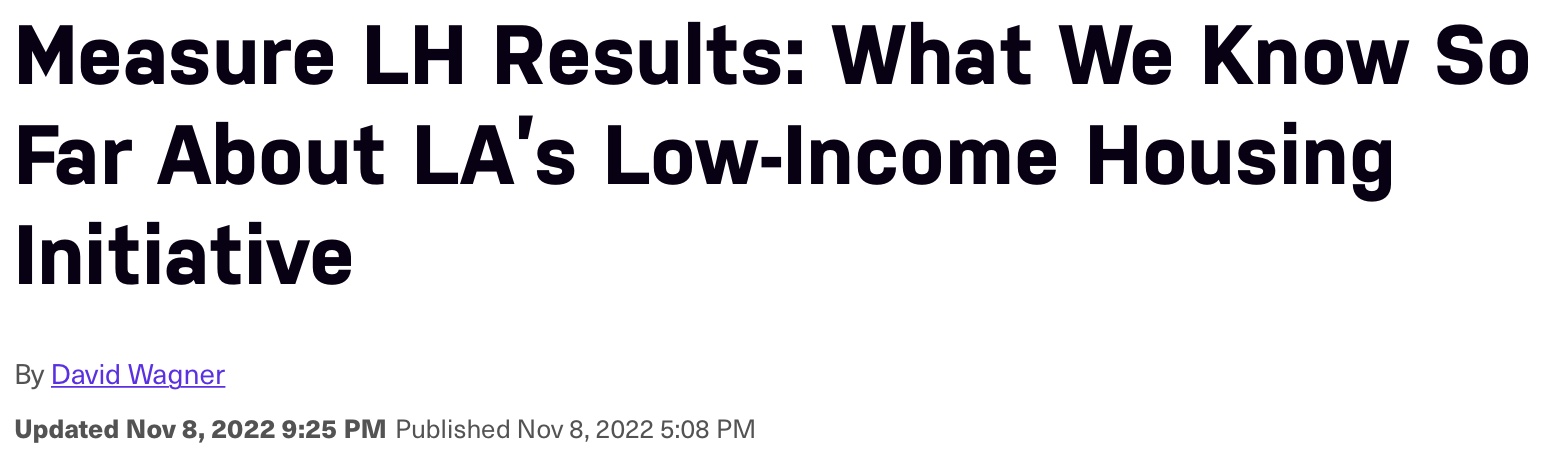

Los Angeles officials are coming to voters, yet again, to ask for approval to develop more publicly funded low-income housing projects across the city. The city is required to ask for voters’ blessing due to a unique state constitutional requirement that critics call a “racist relic.”

If Measure LH passes, pre-existing streams of public funding will continue to flow toward the development of housing for seniors, the unhoused and for struggling low-income workers. But if the measure fails, affordable housing development could grind to a halt in many neighborhoods

Understanding Measure LH

If voters approve Measure LH, they will grant the city the authority to put existing public money toward the development of an additional 5,000 units of affordable housing in each of the city’s 15 council districts. That would add up to a total of 75,000 units of housing across the city for low-income Angelenos

However, the measure does not guarantee that any additional housing will actually get built. It only authorizes the city to reach that level of development before having to ask for voters’ permission again to develop more low-income housing.

This measure is on the ballot thanks to Article 34, an unusual requirement in the California state constitution that gives voters the right to shoot down publicly funded housing projects in their cities. The history of this constitutional requirement dates back to 1950, when Eureka, CA residents teamed up with the California real estate industry to run a campaign that vilified public housing while seeking to preserve segregated neighborhoods (the California Association of Realtors recently apologized for its past role in this racist campaign).

Voters will have a chance in 2024 to pass a state ballot measure that would repeal Article 34. But until then, cities like L.A. need voter approval to pursue publicly financed low-income housing projects. Los Angeles received voter approval in 2008 to develop 3,500 units of additional low-income housing in each council district. But now, a handful of districts have either hit that cap or are close to exceeding it.

Without voter approval through Measure LH, areas including downtown L.A. would be maxed out, and thus barred from using public funding for any further affordable housing development. This could also seriously hamper the city’s state-mandated goal of planning for 185,000 new units of low-income housing by 2029.

You can read more about this measure here.

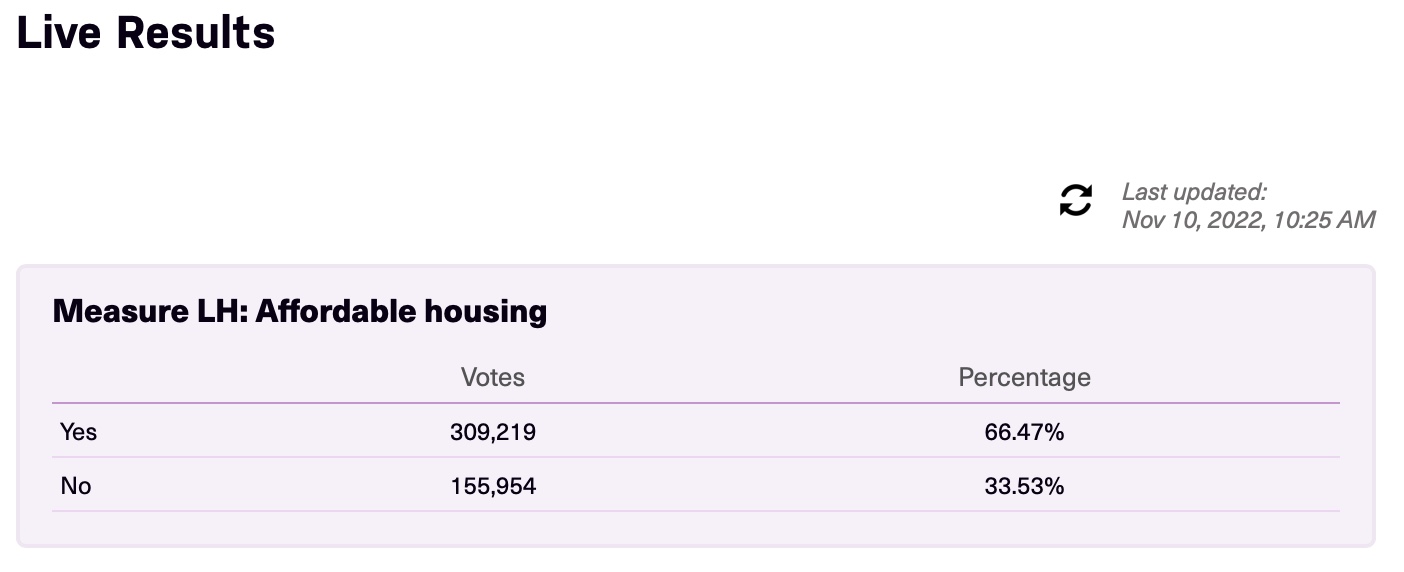

Nope, that’s not some sort of catastrophic explosion in the center of the city—that sound’s just the arrival of Christmas at the Grove. Brace yourself: L.A.’s shopping mall metropolis lights up its Christmas tree with fireworks and a slew of special guests, including Santa himself (may we humbly suggest that you ask Santa this year for a prime spot in that mammoth parking garage). Gloria Estefan will host an evening that includes performances by Andy Grammer, Little Big Town, David Foster and Kat McPhee. Stick around for the fireworks finale (and we’ll reiterate that, yep, anxious Angelenos, those are indeed fireworks that you’re hearing on November 20).

If you’re doing it right, Thanksgiving in Los Angeles means feasting on turkey and the best pies—and finding volunteer opportunities in your community. But what other things to do on Thanksgiving can you partake in? Enjoy the long holiday weekend with a variety of events and these things to do on Thanksgiving in L.A.—from turkey trots to illuminated garden walks to parades.

Ingredients

Pie Crust:

- 1 pie crust homemade or store-bought

Pumpkin Pie Filling:

- 1 15 ounce can pumpkin

- 1 cup packed light brown sugar

- 3 large eggs

- 1/2 teaspoon salt

- 1 1/4 teaspoons ground cinnamon

- 1/2 teaspoon ground ginger

- 1/4 teaspoon nutmeg

- 1/4 teaspoon ground cloves

- 1 teaspoon pure vanilla extract

- 1 1/4 cups heavy cream

- 1/2 cup salted caramel sauce

Instructions

- On a lightly floured surface, roll out the pie dough into a 12-inch circle. Carefully drape the dough over the rolling pin and transfer to a 9-inch pie pan that is 1-½ inches deep. Gently fit the dough into the pan. Trim the dough to 1/2-inch over the pie pan and pinch the edges using your fingers to crimp the rim. You can also use a fork to seal the edges. Place the crust in the freezer for 20 to 30 minutes while you preheat the oven to 375 degrees F.

- Line the pie dough with parchment paper or aluminum foil, then fill with pie weights, dried beans or dry rice. Bake for 20 minutes. Remove from the oven and let cool for 5 minutes. Remove the weights and parchment paper or foil.

- To make the pumpkin pie filling, in a large bowl whisk together the pumpkin, brown sugar, eggs, salt, cinnamon, ginger, nutmeg, cloves, and vanilla extract.

- Add in the heavy cream and salted caramel sauce. Whisk until smooth.

- Pour the pumpkin filling into the partially baked pie crust. Bake for 45 to 55 minutes or until the center is almost set, but still a little jiggly. Don’t over bake.

- When the pie is done baking, turn off the oven and let the pie cool in the oven with the oven door slightly open. This will prevent cracking. Remove from oven when the pie is cooled to room temperature.

- Cut the pie into slices and serve with whipped cream or ice cream, if desired.

![]()